The Anatomy of the Listed BBBEE Share Scheme: A Note on Bula Tsela

Our affair with Broad-Based Black Economic Empowerment transactions is a complicated one. To begin with, there is always going to be an inherent tension in policy that combines market-oriented economic policy with redistributive social policy. This tension has been obvious in the implementation of BBBEE policy in South Africa, and BBBEE share schemes have not been spared.

Many would argue that the BBBEE policy and its associated transactions have only benefitted the elite. Recent studies have shown, however, that the policy may be beginning to benefit more than just the usual suspects.

One of the ways this has been achieved has been through listed share schemes that benefit community trusts, employees, and qualifying retail investors. The listed share scheme often provides leveraged exposure to the listed company proposing the deal. There are some exceptions. For instance, Multichoice’s Phuthuma Nathi scheme holds shares only in Multichoice SA, and not the operations in the rest of the African continent. An article in this week’s Financial Mail by The Finance Ghost set outs the listed BBBEE share scheme universe rather neatly here, so this may be a little repetitive.

It is important to know what it is you’re buying and how much it will cost you. Leveraged exposure simply means your stake in the company is funded with some debt, either from banks or a vendor-funded structure.

This debt is paid by dividend flows and you are therefore restricted from selling those shares for a specified period of time. It is also important that you’re sure that the company you are investing in is a strong dividend payer. Listed BBBEE share schemes trade at a discount to the share price of the listed company.

This is to make up for the lack of liquidity of the shares because you are locked in for, say, five to ten years. Currently, the market seems to believe that a fair liquidity discount is about 50%. For example, The SASOL BBBEE share scheme trades as SOLBEI, and has been trading below R150. While SASOL shares trade at around R385 (as of 3 May 2022).

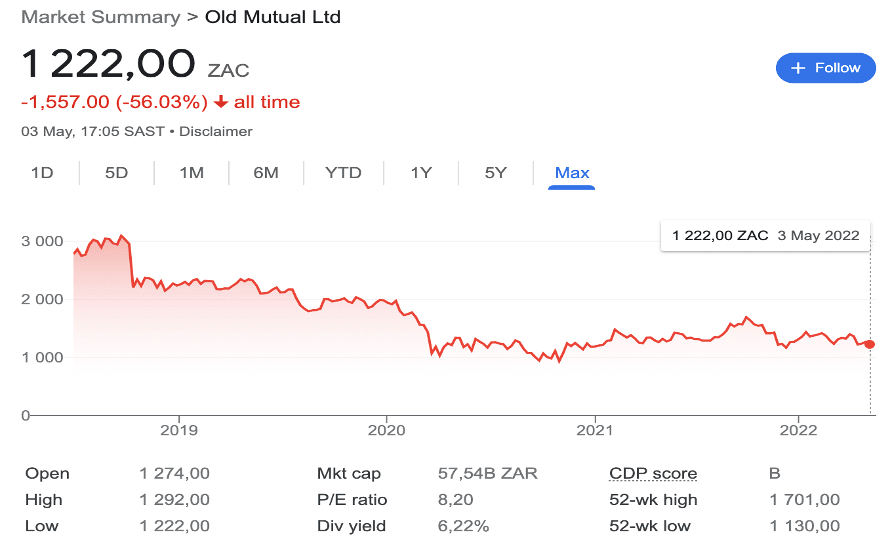

On the 20th of April, Old Mutual announced that it would list a BBBEE share scheme that would include an employee scheme, a community trust and vehicle for qualifying black retail investors. As many commentators (My favourite being The Finance Ghost) have pointed out that this may seem like a progressive step, bringing black ownership of Old Mutual to about 30%, but at what cost? I’ll explain, technicalities aside, while the funding rate is attractive (85% of prime), and with Old Mutual being a strong dividend payer (6,22%), they are only offering a liquidity discount of 15%. With the market seemingly insistent on a 50% discount, the deal losses a lot of its appeal at this entry price. Before pulling the trigger on this deal consider what the very real possibility of the discount widening to about 50% may mean for your investment.

BBBEE has demonstrated policy potential to contribute to socio-economic transformation. While the number of listed BBBE share schemes is limited, there are many examples of how they have worked out well for qualifying investors. It is however very important that our eagerness to see progress in transforming the ownership patterns of our largest corporations, does not lead us into accepting a deal that may change ownership but offer little to no “empowerment”.

The transformation agenda has come at a high cost to the black majority of South Africa as it is. I enjoy a BBBEE deal as much as the next BMF member, and this is by no means investment advice, but a call to always do your own research and for BMF members to begin the conversation around the structure of these deal and whether they can conceivably deliver change beyond the share register and BBBEE scorecard of these large corporations.

The policy, the agenda, is meant to change lives!

It’s time we uncomplicate our affair with one of the not so many tools we have to transform the ownership patterns of our economy and change lives.

Responses